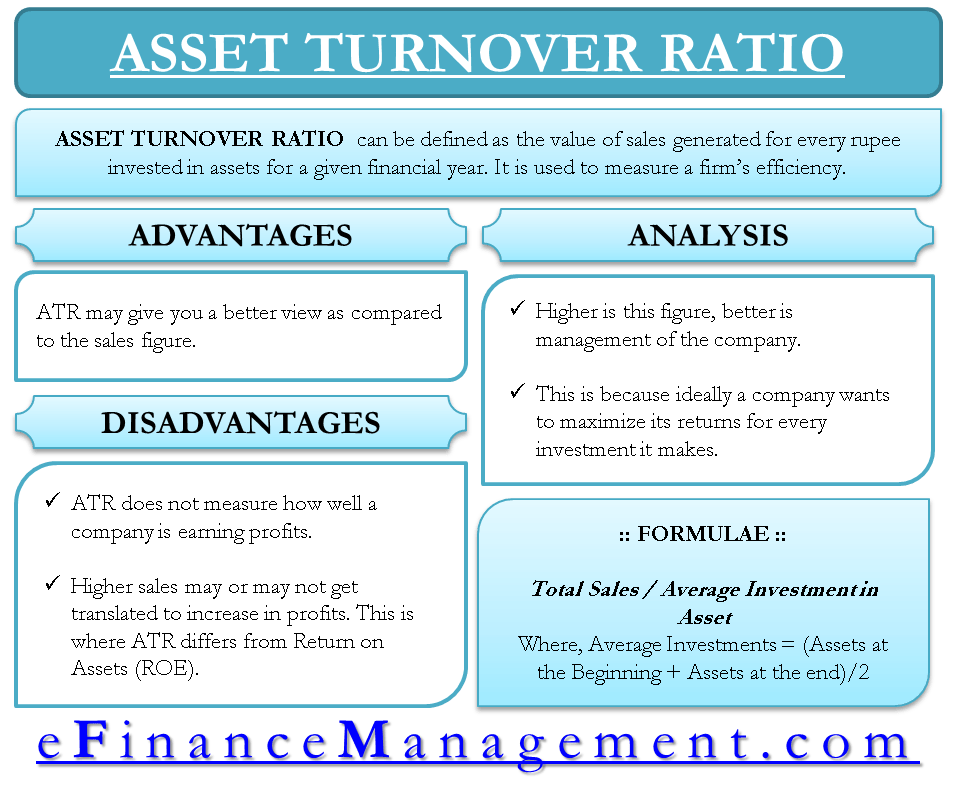

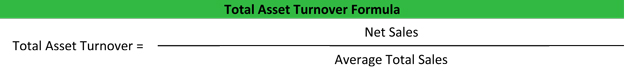

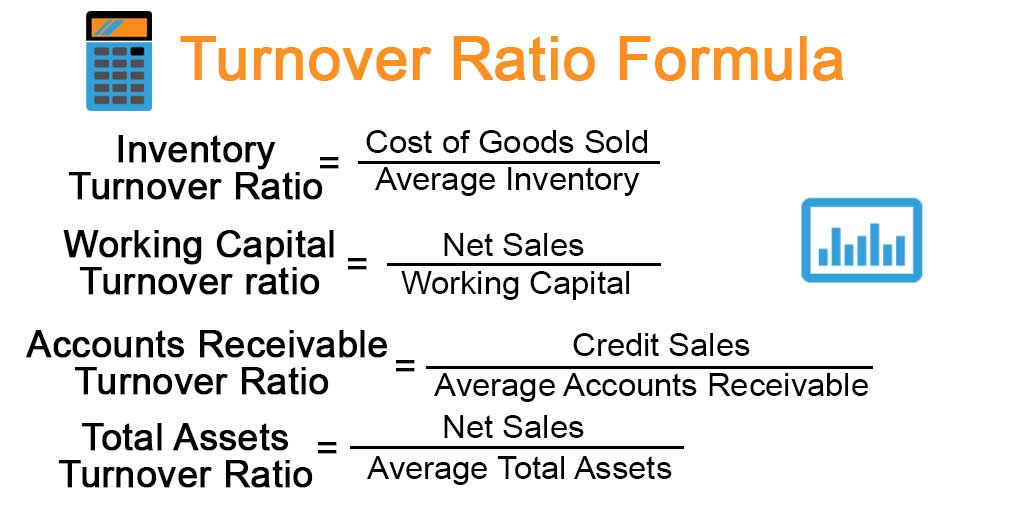

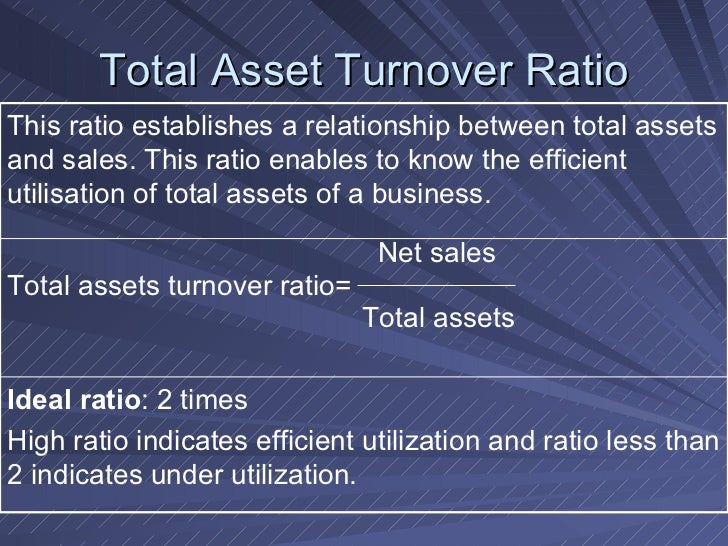

Physical assets include things like machinery, equipment, and real estate, while financial assets include things like cash, investments, and accounts receivable. Total assets refer to the total value of all of a company's physical and financial assets. Net sales are an important measure of a company's financial performance because they reflect the actual revenue that the company is generating from its operations. Net sales refer to the total revenue generated by a company from the sale of its products or services, after deducting returns, allowances, and discounts. The asset turnover ratio is calculated by dividing a company's net sales by its total assets. Understanding the Components of Asset Turnover Ratio Overall, the asset turnover ratio is a useful tool for understanding a company's financial performance and for identifying potential opportunities or risks. This can help investors and analysts to identify companies that are outperforming their peers, or to identify trends in a company's financial performance. In addition, the asset turnover ratio can be used to compare the efficiency of different companies within the same industry, or to compare a company's performance over time. For example, a low asset turnover ratio may indicate that a company is not maximizing the potential of its assets, which could be a red flag for investors. The asset turnover ratio is an important financial metric for investors and analysts because it can provide insight into a company's financial performance and help to identify potential problems or areas for improvement. A high asset turnover ratio indicates that a company is using its assets effectively to generate sales, while a low asset turnover ratio may indicate that the company is not using its assets efficiently. The asset turnover ratio is significant because it measures the efficiency of a company's use of its assets in generating revenue. It is important to note that the asset turnover ratio should be considered in conjunction with other financial metrics, such as the return on assets (ROA) and the profit margin, to get a complete picture of a company's financial performance.

The asset turnover ratio can be used to compare the efficiency of different companies within the same industry, or to compare a company's performance over time. A high asset turnover ratio indicates that a company is effectively using its assets to generate revenue, while a low asset turnover ratio may indicate that a company is not using its assets efficiently. The asset turnover ratio is an important measure of a company's performance because it indicates how well the company is using its assets to generate sales. It is calculated by dividing a company's net sales by its total assets. The asset turnover ratio is a financial metric that measures the efficiency of a company's use of its assets in generating revenue.

#Total asset turnover high or low how to

Finally, we will look at how to use the asset turnover ratio to improve efficiency and profitability. We will also discuss how the asset turnover ratio can be used to compare companies and evaluate a company's performance. In this article, we will discuss the significance of the asset turnover ratio, how it is calculated, and how it can be used to make better financial decisions. It is a measure of how efficiently a company uses its assets to generate sales.

#Total asset turnover high or low software

Analyzing the Significance of Asset Turnover Ratio Posted In | Finance | Accounting Software | Gridlex AcademyĪsset turnover ratio is an important metric used in financial analysis that measures a company's ability to generate revenue from its assets.

0 kommentar(er)

0 kommentar(er)